Copy trading is a simple way to follow a strategy without placing every trade manually — but it still involves risk.

Independent documentation

Copy Trading

Just how it works.

A calm, beginner-friendly walkthrough of what copy trading is and how you can start without being a trading expert. You don’t need years of experience — just a simple start.

Disclaimer: Educational content only. No financial advice. You may lose some or all of your capital.

- Transparent history

- Trade visibility

- Simple monitoring

Transparency promise

You don’t need to be an expert to try copy trading.

This page is for people who want to understand the concept, start calmly, and follow a structured process — no hype, no promises.

Start with a small amount

Test with money you can afford to lose, then build experience before you scale.

Transparent account & history

You can see trades, history, and performance in your own account — nothing is “hidden.”

No screen-time required

Check in weekly — not every minute. Less stress, more structure.

Copy trading for beginners, how it works in practice

Three steps. Simple setup. But remember: results can vary significantly.

Create an account + complete KYC

You register and verify your identity. This is standard with reputable providers.

Deposit funds and choose a risk level

Start conservative. Higher risk can mean bigger swings — up and down.

Connect copy trading

The strategy is copied automatically. You can pause, stop, or adjust the risk profile.

Myths vs facts

Many people don’t start because they assume it’s complicated. Let’s clear up the common misconceptions.

Myth

- “I need years of trading experience to start.”

- “Copy trading means guaranteed profit.”

- “This is just another ‘online scheme’.”

Fact

- You don’t need to be an expert — but you do need risk understanding.

- No guarantees. Losses and drawdowns can happen.

- Your account is in your name (KYC), and you can view trades/history.

Why KYC — and why it is a good thing

KYC can feel annoying. But if you want to avoid shady setups, it’s a positive sign there’s structure and traceability.

- Your account is linked to you (identity verified)

- A more structured and transparent process

- Standard practice with brokers and financial platforms

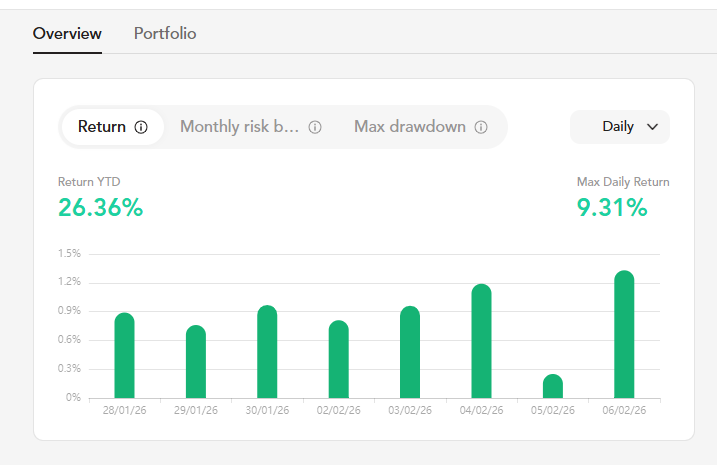

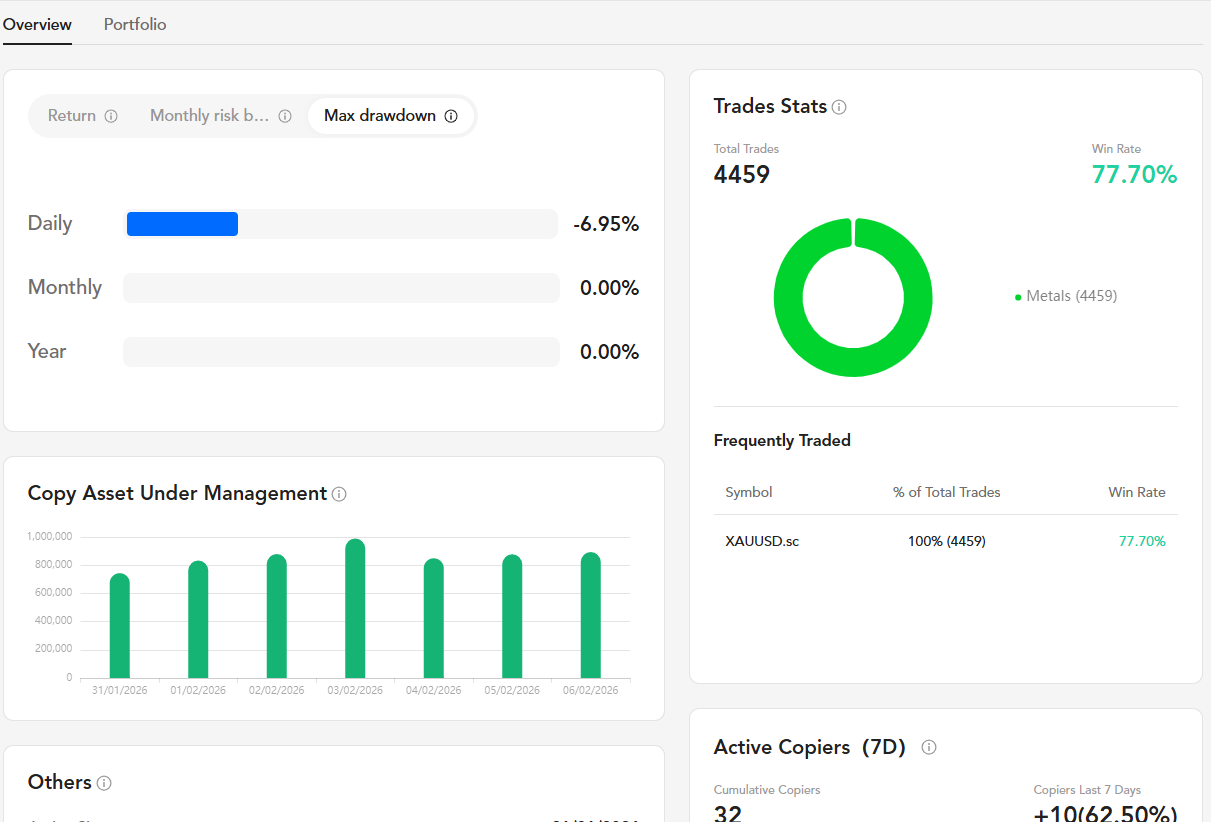

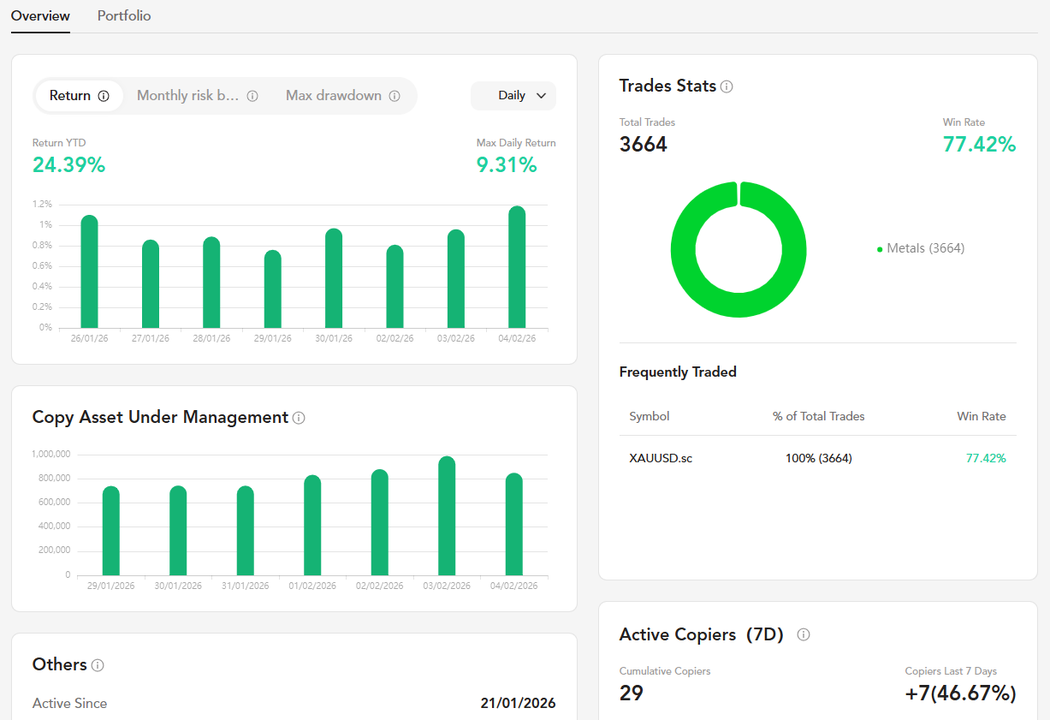

History and insights

This section shows how performance can look: growth phases, drawdowns, and month-to-month swings.

Risk and what you must understand before starting

If you can’t handle volatility or you expect guarantees, you should not start.

- You can lose your entire deposit

- Results can vary significantly month to month

- Higher risk means bigger swings (up and down)

- Market conditions can change fast

Get started in 15 minutes (practical checklist)

Start small, choose conservative settings, and evaluate after a few weeks — not after one day.

The checklist

- Create an account + complete KYC

- Deposit a amount you can afford

- Connect copy trading (I can send the setup)

- Choose a conservative risk profile

- Check weekly and adjust calmly

A realistic expectation

This page exists so you understand what copy trading is, what you’re actually doing, and what can go wrong. Starting small gives you experience without taking unnecessary risk.

Don’t start with money you need for bills. Test calmly, and let long-term results (including drawdowns) guide your decision.

I’m not a financial advisor. This is information only.

If you prefer Telegram, message me “START” and I’ll send the checklist + setup steps.

- How it works (simple explanation)

- Risk settings and expectations

- How to start small (calm process)

About me

My name is Brian Kamp. I’m sharing this because I’ve been looking for a structured, easy-to-understand way to test copy trading, without promises, without hype, and with a clear focus on risk.

Recently I found a team I’m comfortable collaborating with after real conversations about how the setup works, what the limitations are, and how risk is handled in different market conditions. They use AI-assisted tools to support execution — but I treat it as a tool, not a promise. I’m still testing conservatively, documenting results, and keeping the focus on risk management first.

- No promises — only transparency

- Start small — think long-term

- Risk first — profit second

Want the checklist and setup steps? Message me “START” on Telegram — or send an email using the form.

Want to know more?

Send me a short message and I’ll reply personally with the next steps.

Copy trading guides

Want short, practical guides on risk-first copy trading? Start with the blog overview.

See all guidesFAQ

The most common questions — short and straightforward.